Voice-based Trade Compliance

Voice-based Trade Compliance

Executive summary

Convert the voice-based advisor to client phone conversations into text. Analyze for possible breaches of regulatory and compliance policies. This multi-step analytical process involves voice-to-text transcription, a compliance ontology, text parsing & natural language understanding.

Problem statement

Many if not most client advisors to client communications still occur via phone. These conversations happen in a black box environment that is difficult to track and audit. Potential compliance breaches in areas such as insider trading or conflict of interest can only be identified and intercepted at great cost while only listening in on select phone calls. The vast majority of conversation remains unchecked, leaving the organization in the dark and at risk. Often compliance is at odds with sales – one controlling the business, the other pushing the boundaries of acceptable risk.

Target market / Industries

Described use case can be efficiently applied in the industries where the track / audit of the voice-based communication is required.

Solution

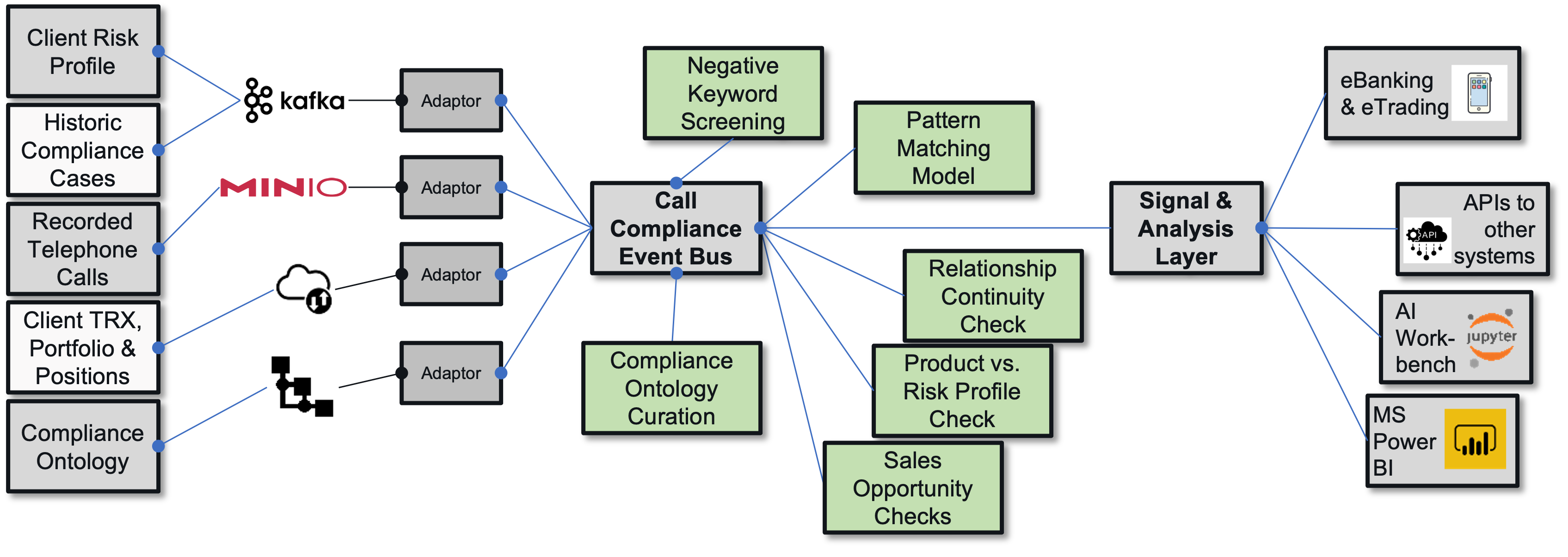

Leveraging your existing Public Branch eXchange (PBX) phone recording infrastructure & partnering with your choice of voice-to-text transcription service, the solution is to automatically screen every conversion. The transcribed text files are parsed against the Sales & Compliance Ontology. Using Natural Language Understanding (NLU) the use case identifies which call advice and trade decisions occurred and high-lights possible compliance breaches.

Once the predictions become more accurate a sales focused “topics-of-interest“ screening can be added.

The solution included:

- Voice to text transcription

- Word parsing of text-based inputs

- Compliance & Sales Ontology matching

- Identification of possible compliance breaches (and / or sales topics of interest)

- Aggregation of findings, reporting, alerting

- Action recommendation

Example Use Case Agent Cascade

Stakeholders

- Compliance

- Security

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Relationship Manager – Client Conversations (Voice or Text)

- Client portfolios - positions / transactions

Assets & Artefacts:

- Unstructured Data

- Semantic Harmonization

- Natural language processing

- Personalization

The deliverables included:

- Sales & Transaction Monitoring Ontology

- Use case specific orchestration flow

Impact and benefits

Sales Compliance headcount was reduced by 3 Full Time Employees while screening coverage increased to 90% (before only spot checks) and resolution quality focuses on sales and compliance.

Testimonials

“The overall sensitivity of advisors to client‘s sentiment and requirements has increased. Also, we improved the understanding how compliance and sales can work together to achieve client satisfaction.” — Ms. Milica L., Chief Risk Officer, Swiss Private Bank

Tags / Keywords

#voicetradecompliance #tradecompliance #compliance #bank #communicationscreening #financialservices

Feedback

Was this page helpful?

Glad to hear it! Please tell us how we can improve.

Sorry to hear that. Please tell us how we can improve.