This the multi-page printable view of this section. Click here to print.

Solutions

- 1:

- 2:

- 3: Automating Marketing Data Analysis

- 4: Churn Analysis and Alerting – Financial Services

- 5: Classification of products along different regulatory frameworks

- 6: Curn Analysis and Alerting – General

- 7: First Notice of Loss Automation

- 8: Idea to Trade / Next Best Product - Financial Services

- 9: Idea to Trade / Next Best Product - General

- 10: Intraday Liquidity Management Optimization

- 11: Metadata-controlled Data Quality & Data Lineage in Production

- 12: Onboarding and Fraud Remodelling - Financial Services

- 13: Onboarding and Fraud Remodelling - General

- 14: Prospecting 360 Degree

- 15: Prospecting 360 Degree - general

- 16: Regulatory Single Source of Truth

- 17: Sensor-based Monitoring of Sensitive Goods

- 18: Voice-based Trade Compliance

1 -

Balance Sheet Quality Control

Executive summary

It is a routine task for the banks to assess the balance sheet quality for their corporate clients on an annual basis and to categorize them according to the risk ratings. The use case contributes to the optimization of this routine task by automating the balance sheet comparison process and setting up smart notificaton mechanism.

Problem statement

Target market / Industries

Solution

The solution

Balance Sheet Quality Control Model - different use case - for financial services -banks would have to identify the balance sheet quality for the corp clients - look on the balance sheet annually - analize and to give different risk ratings - use case automation of the risk assessment - skip the balance sheets that are very similar to previous years. If significant change - analyze manually - SEPARATE USE CASE - Notification Hierarchy! - depending on the event found in the balance sheet - different people need to be notified.

The solution included:

Slide

Stakeholders

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

Assets & Artefacts:

The deliverables included:

Impact and benefits

The use-case implementation resulted in:

Testimonials

“…” — Mr. XXX YYY, Title, Company ZZZ.

Tags / Keywords

2 -

Corporate Clients Quality Assessment

Executive summary

Implemented a fully automated data ingestion and orchestration system for the structural assessment of Corporate Client‘s balance sheets. Designed and implemented a two-level approach that includes both existing and publicly available information in a structured or semi-structured format. Extraction of relevant changes which are then compared to prior periods, explicit new data deliveries or internal policy baselines and thresholds.

Problem statement

Often banks are facing high staff turnover rate and general lack of advisory staff that is resulting in lack of client intelligence. Detailed client profiles either does not exist or outdated and does not reflect the latest situation. As a result it is hardly possible to increase the share of wallet of existing corporate clients.

Target market / Industries

Target industry for this use-case is Financial Services – Banks, Insurances, Asset Management Firms

Solution

The solution is aimed to understand which corporate clients are able to gain a bigger share of wallet. Using the publicly available information, such as news and social media, the selling proposition for those clients is outlined. At the next stage the segmentation of those clients is performed to understand how much efforts need to be put to increase share of wallet and to shortlist most prominent of them. This use case can be effectively combined with the Churn Analysis use-case.

Stakeholders

-Sales management

- Sales staff / Relationship Management

- Key Account Management

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Client base

- Transaction / product usage history

Assets & Artefacts:

The deliverables included:

Impact and benefits

The use-case implementation resulted in:

Testimonials

“…” — Mr. XXX YYY, Title, Company ZZZ.

Tags / Keywords

3 - Automating Marketing Data Analysis

Marketing Data Analysis

Executive summary

Implemented the first service- and on-demand based big data and data science infrastructure for the bank. Data pipelines are built and maintained leveraging two key infrastructure components: a custom-built aggregation tool and the marketing content & event platform. The aggregation tool builds the data lake for all analytics activities and enables the marketing platform to organically grow customer and campaign projects.

Problem statement

Relationship Managers spend too much valuable time researching talking points and themes that fit their different client profiles. A simple product recommender usually cannot grasp the complexity of private banking relationships and hence the product recommendations are usually without impact.

Target market / Industries

Private banking, wealth management, All relationship intense industries, i.e. insurance

Solution

Jointly with the client we developed a private banking marketing ontology (knowledge graph or rule book) that enabled various Machine Learning (ML) models to parse broad catalogue of unstructured data (financial research, company analysis, newsfeeds) to generate personalized investment themes and talking points.

The solution included:

- Private banking marketing ontology

- Thematic aggregator agents

- Personalized clustering

Slide

Stakeholders

- Head of marketing and campaigns

- Market heads

- Relationship Manager

- Chief Investment Officer

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Access to CRM details

- Client transaction history

- Research details

Assets & Artefacts:

- Financial Product Classification

- Product Risk Classification

- Event Lifecycle

The deliverables included:

- Private banking marketing ontology

- Thematic aggregator agents

- Personalized clustering

- End to end event cascade and workflow integration

Impact and benefits

Achieve a fully transparent Close the Loop on Campaigns and increased RoMI by 18%. Furthermore, this first mover program established the big data sandbox as a service capability to the entire bank. Also this project enabled marketing for the first time to close the loop between their digital client touchpoints and the events and campaigns run.

The use-case implementation resulted in:

- +18% increase in RoMI (return on marketing investments)

- -17% savings on campaign spend

Testimonials

“Using StreamZero we were able to digest a massive amount of text and extract personalized investment themes which allows our RMs to increase their face time with the clients and surprise them with the meaningful content.” — Mr. R. Giger, Head of Marketing and Campaigns, Swiss Private Bank

Tags / Keywords

#marketdataanalysis #bigdata #bigdatainfrastructure #datascience #datascienceinfrastructure #financialservices #bank

4 - Churn Analysis and Alerting – Financial Services

Churn Analysis and Alerting

Executive summary

Screening your existing client population for signs of dissatisfaction and pending attrition can involve a broad range of analysis. Usually the focus is given to transaction pattern analysis. And while this may prove helpful it can be misleading in smaller banks with limited comparative data. We thus integrate a broader variety of less obvious indicators and include an advisor based reinforcement loop to train the models for a bank‘s specific churn footprint.

Problem statement

When clients close their accounts or cancel their mandates, it usually does not come as a surprise to the Relationship Manager (RM). But for obvious reasons, the RM tries to work against the loss of a client with similar if not the same tools, processes and attitudes that have led to a client being dissatisfied. This is not to say that the RM manager is the sole reason for churn. But often clients do not or not sufficiently voice their issues and simply quit the relationship. To search, become aware and then listen for softer and indirect signs is at the heart of this use case.

Target market / Industries

The described use case can be efficiently applied to any industry that is providing services to a large number of clients and has a large number of transactions. Particularly following industries are benefiting most of this use-case:

- Financial services

- Insurance

Solution

Using historical data, client communication and structured interviews with client advisors, we create a bank-specific churn ontology, that is then used to screen existing clients on an ongoing basis. Creating an interactive reinforcement loop with new churn-cases, this classification, predictor and indicator approach is ever more fine tuned to specific segments, desks and service categories. As direct and ongoing Key Performance Indicators (KPIs) churn ratios and client satisfaction are measured alongside Assets under Management (AuM), profitability and trade volumes for the respective clients are classified as “endangered”. Usually a gradual improvement can be monitored within 3-6 months from the start of the use case.

The solution included:

- Initial typical churn cause analysis based on historical data (client positions, and transactions)

- Ideally inclusion of CRM notes and written advisor to client communication (prior to churn)

- Sales & Churn Ontology setup & subsequent ontology matching

- Identification of likely bank churn footprint & learning / improvement loops

- Aggregation of findings, reporting, alerting & action notifications

Stakeholders

- Chief Operations

- Client advisory, Relationship and Sales management

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Historic data about churned clients

- Client portfolios - positions / transactions

- Ideally pre-leave client-advisor communications

Assets & Artefacts:

- Client Behavioral Model

- Churn Prediction

- Action Monitoring

The deliverables included:

- Sales & Churn Indicator Ontology

- Use case specific orchestration flow

Impact and benefits

Lowered churn rates for distinct client segments by 16% after 6 months. Increased AuM / trades for clients „turned-around“ by about 25% within 6 months after “re-win”.

The use-case implementation resulted in:

+8% clients saved prior to loss of relationship

+24% reduction of customer asset outflows

Testimonials

“Changing the attitude we deal with churn from feeling like a failure to working a structured process, made all the difference. Turning around a dissatisfied client is now something transparent and achievable.” — Mr. Roland Giger, Head of Client Book Development, UBS

Tags / Keywords

#churn #churnanalysis #financialservices #insurance #bank #retention #clientretention #customerretention

5 - Classification of products along different regulatory frameworks

Classification of products along different regulatory frameworks

Executive summary

Multi-dimensional and ontology-based classification of products along different regulatory frameworks and systematic mapping of the company’s internal specialist expertise in a knowledge graph that can be used by both humans and algorithms or other systems.

Problem statement

Depending on the applicable regulation, the products and materials need to be classified for further usage. This requires an effective classification approach and also involves the challenge of knowledge management. Respective product / material information need to be extracted from various sources, cuch as core systems, product information systems, etc. This task usually requires lots of time-consuming manual work utilizing the domain knowledge.

Target market / Industries

The use case can be efficiently applied in the following industries:

- Financial services

- Manufacturing

- Retail

Solution

The solution is based on analyzing the domain knowledge and converting it into ontology. Domain knowledge is used as an input for the Machine Learning (ML) model: ontology-based annotator component is analyzing the available data, be it text, unstructured or semi-structured data and feed it into the ML model to perform the classification. The event-based workflow increases the efficiency and stability of the classification process.

Stakeholders

- Management

- Product management

- Domain experts

- Management

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Domain expertise in the ontology

- Detailed data that needs to be classified

Assets & Artefacts:

- Ontology-based annotator (DFA)

- Workflow engine

The deliverables included:

- Automated classification data or documents – final workflow

Impact and benefits

The classification process, that cannot be done manually with reasonable manpower and time resources is now automated.

Tags / Keywords

#classification #classificationofproduct #classificationofmaterial #classificationautomation #automation #production #financialservices #production #retail

6 - Curn Analysis and Alerting – General

Churn Analysis and Alerting

Executive summary

Screening your existing client population for signs of dissatisfaction and pending attrition can involve a broad range of analysis. Usually the focus is given to transaction pattern analysis. And while this may prove helpful it can be misleading in smaller companies with limited comparative data. We thus integrate a broader variety of less obvious indicators and include an advisor based reinforcement loop to train the models for a company’s specific churn footprint.

Problem statement

When clients close their accounts or cancel their subscriptions, it usually does not come as a surprise to the sales management. But for obvious reasons, the sales manager tries to work against the loss of a client with similar if not the same tools, processes and attitudes that have led to a client being dissatisfied. This is not to say that the sales manager can the sole reason for churn. But often clients do not or not sufficiently voice their issues and simply quit the relationship. To search, become aware and then listen for softer and indirect signs is at the heart of this use case.

Target market / Industries

The described use case can be efficiently applied to any industry that is providing services to a large number of clients and has a large number of transactions. Particularly following industries are benefiting most of this use-case:

- Retail

- Entertainment

- Mass media

Solution

Using historical data, client communication and structured interviews with sales people, we create a company-specific churn ontology, that is then used to screen existing clients on an ongoing basis. Creating an interactive reinforcement loop with new churn-cases, this classification, predictor and indicator approach is ever more fine tuned to specific segments and service categories. As direct and ongoing KPIs churn ratios and client satisfaction are measured alongside generated revenues, profitability for the respective clients are classified as “endangered”. Usually a gradual improvement can be monitored within 3-6 months from the start of the use case.

The solution included:

- Initial typical churn cause analysis based on historical data (client positions, and transactions)

- Ideally inclusion of CRM notes and written sales to client communication (prior to churn)

- Sales & Churn Ontology setup & subsequent ontology matching

- Identification of likely company churn footprint & learning / improvement loops

- Aggregation of findings, reporting, alerting & action notifications

Stakeholders

- Chief Executive

- Chief Operations

- Sales and Marketing

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Historic data about churned clients

- Client portfolios - positions / transactions

- Ideally pre-leave client-advisor coms

Assets & Artefacts:

- Client Behavioral Model

- Churn Prediction

- Action Monitoring

The deliverables included:

- Sales & Churn Indicator Ontology

- Use case specific orchestration flow

Tags / Keywords

#churn #churnanalysis #retail #entertainment #massmedia #retention #clientretention #customerretention

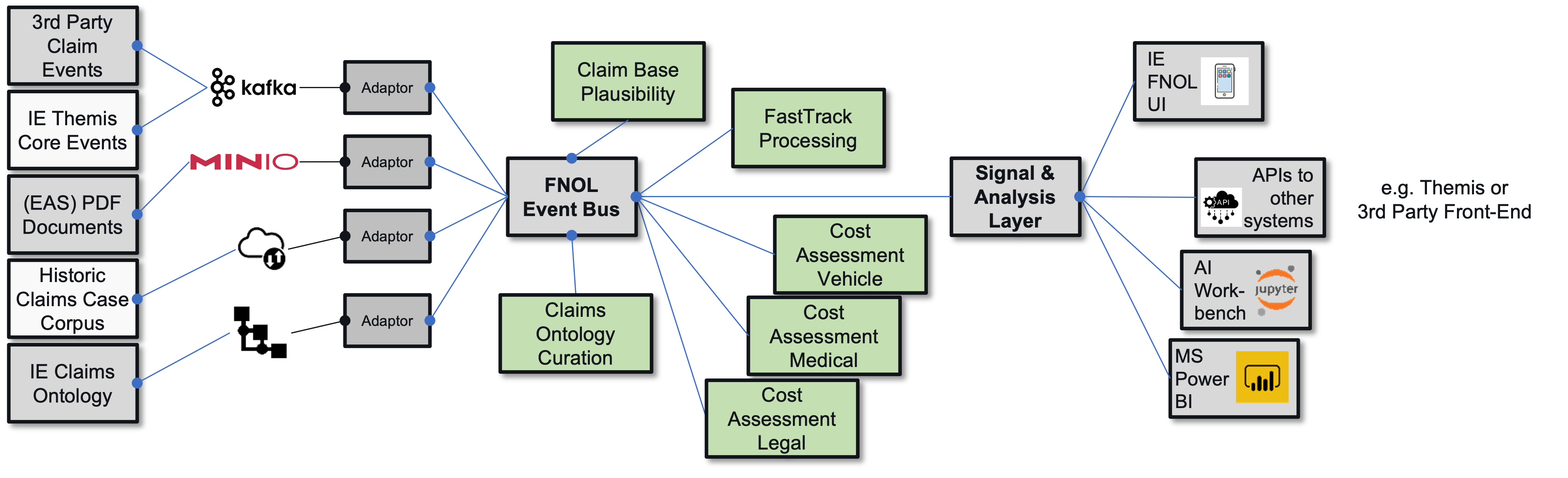

7 - First Notice of Loss Automation

Cross Jurisdictional First Notice of Loss Automation

Executive summary

The handling of cross-jurisdictional accident resolutions involving more than one country was automated for a pan-European insurance group.

Problem statement

The client was bound to a proprietary existing legacy core system which served all operational processes but did not lend itself to agile, digital use cases. Within the cross-jurisdictional context various third-party party core systems of partner network insurers also had to be integrated in the overall flow. In addition to already digital content, file-based and even handwritten forms of the European Accident Standard had to be taken into account. The growth of the customer did not allow for a continued manual processing.

Target market / Industries

Focused on Industry segments, but easily configured to work for similar case management related processes that involve expert knowledge combined with extensive manual fact checking.

Solution

The customer wanted to automate and streamline the handling and ideally straight-through-processing of new cases whenever the context allowed for such an option and involve the correct stakeholders when a human resolution was called for. An existing data warehouse provided historic resolution data that could be used to train various Machine Learning (ML) models. In addition, a knowledge graph contained the expertise on how the company wanted to deal with certain constellations in the future.

The solution included:

- Ingestion of all relevant base data into a use case message bus

- Automated plausibility check of the base claim (e.g. policy paid, client = driver, couterparty validity)

- ML model to assess “Fast Track” options (depending on likely cost footprint)

- Helper ML models to assess cost for vehicle, medical and legal cost

- Curation model to extend “fast track” rules within knowledge graph

Example Use Case Agent Cascade

Stakeholders

- Head of Operations / Claims Handling

- Domain Expert for Motor Vehicle Accidents Underwriting

- Domain Expert from Accounting & Controlling

- Tech Expert for mobile field agent application

- Tech Expert for core system

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Core data items on policies, clients, risk vs. claim details

- Core data from insurance partner network

- Historic claims & claim resolution data warehouse

Assets & Artefacts:

- Claims knowledge graph & ontology

- Vehicle, medical and legal cost assessment prediction models

- Fast track viability assessment model

- Ontology curation / extention model

The deliverables included:

- Automated decisioning on human vs. straight-through-processed case handling

Impact and benefits

The use-case implementation resulted in:

- the client was able to manage a +35% annual growth with fewer headcount (-3 FTE)

- turnaround times of automated cases could be reduced by >90%, from 8-10 working days to 1 day

- turnaround times of manual cases could be reduced by 30% due to elimination of manual triage

- the initial use case paved the way for additional AI based automation ideas

Testimonials

“We were sceptical about the limits of automation with rather difficult data quality we initially set out with. The learning loop for both the agents involved as well as the predicition models was a true surprise to me.” — Mr. Okatwiusz Ozimski, Inter Europe AG

Tags / Keywords

#insurance #firstnoticeofloss #FNOL

8 - Idea to Trade / Next Best Product - Financial Services

Idea to Trade / Next Best Product

Executive summary

To support advisors and clients with a “next best product” recommendation, a closed loop flow has been established from Research / Chief Investment Officer to Relationship Managers and eventually to the client. Evaluating which recommendations worked for RMs and Clients allowed for a learning loop informing Research & CIO to improve selection & tailoring of investment themes.

Problem statement

The information flow from research or strategic asset allocation (CIO) to client advisors and eventually to clients does rarely follow a structured path. Instead the bank‘s “house view” is communicated broadly to all front-office staff and portfolio managers. They then use their direct client relationship to assess risk appetite and extract specific investment themes or ideas from their client interaction. If these match, the resulting research / advice is forwarded to the client. It seems like a lucky punch if product information leads to a trade / product sale.

Target market / Industries

The challenge of customizing the offering to the customer profile is a common challenge across the industries. Financial services industry is benefiting most from this use case that can be efficiently applied e.g. in Industries, that are benefitting most of this use-case are:

- Banks

- Investment and finance firms

- Real estate brokers

- Tax and accounting firms

- Insurance companies

Solution

Starting with investment themes / product and occasion specific sales / investment opportunities, the existing client‘s portfolios and client to bank communication is screened for possible gap / fit. Research or asset allocation can then focus their efforts on topics suggested by front-office staff and / or clients themselves. Observing and identifying trade success the best practices are understood and can be multiplied across other (similar) client scenarios. Asset allocation and advisors work collaboratively as they both evaluate which information / proposals / investment ideas are forwarded to clients (and then accepted or not) and which ones are kept back by advisors (and for what reasons).

The solution included:

- Clustering & topic mapping of existing marketing material & client portfolio structures

- Optionally inclusion of CRM notes and written advisor to client communication

- Sales Ontology setup & learning loop inclusion & topic matching

- Identification of individual investment themes / topics of interest

- Aggregation of findings, reporting, alerting & action recommendation

Stakeholders

- Chief Investment Officers (CIO)

- Client Advisors / Relationship Managers

- Product Managers

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Sales organization setup (desks / books)

- Client to Client / Client to Company graphs

Capabilities utilized:

- Unstructured Data

- Semantic Harmonization

- Natural Language Processing

- Personalization

Assets & Artefacts:

- Financial Product Ontology

- Analytical CRM Models

The deliverables included:

- Sales & Onboarding Ontology

- Use case specific orchestration flow

- Integration with many info sources

Impact and benefits

Proposal / offer conversion rates were increased by 42% after an initial learning curve & algorithm calibration phase of 6 months resulting in additional Asset under Management growth of 8% from targeted clients.

The use-case implementation resulted in:

+18% increased targeted product sales

+8% share of wallet

Tags / Keywords

#ideatotrade #nextbestproduct #salesadvice #financialservices #bank #insurance #investment

9 - Idea to Trade / Next Best Product - General

Idea to Trade / Next Best Product recommendation

Executive summary

To support sales people and clients with a “next best product” recommendation, a closed loop flow has been established from Marketing / Research to Sales and eventually to the client. Evaluating which recommendations worked for Sales and Clients allowed for a learning loop informing Product Management to improve selection & tailoring of the offerings.

Problem statement

The information flow from Development and Product Management to Sales and Marketing and eventually to clients does rarely follow a structured path. Instead the company‘s “house view” is communicated broadly to all staff. Sales then use their direct client relationship to assess customer needs and extract specific requirements or ideas from their client interaction. If these match, the resulting research / advice is forwarded to the client. It seems like a lucky punch if product information leads to a trade / product sale.

Target market / Industries

Any industry which has enough data about the customer to make a recommendation for the next action / product will greatly benefit from this use-case.

Solution

Starting with product review and occasion specific sales opportunities, the existing client‘s portfolios and client communication are screened for possible gap / fit. Research / Product Management can then focus their efforts on topics suggested by Sales and Marketing staff and / or clients themselves. Observing and identifying trade success the best practices are understood and can be multiplied across other (similar) client scenarios. Product Management and Sales work collaboratively as they both evaluate which information / proposals / products are presented to clients (and then accepted or not) and which ones are kept back (and for what reasons).

The solution included:

- Clustering & topic mapping of existing marketing material & client portfolio structures

- Optionally inclusion of CRM notes and written Sales to client communication

- Sales Ontology setup & learning loop inclusion & topic matching

- Identification of individual products / topics of interest

- Aggregation of findings, reporting, alerting & action recommendation

Stakeholders

- Top Management

- Sales and Marketing

- Product Managers

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Sales organization setup (desks / books)

- Client to Client / Client to Company graphs

Capabilities utilized:

- Unstructured Data

- Semantic Harmonization

- NLP

- Personalization

Assets & Artefacts:

- Product Ontology

- Analytical CRM Models

The deliverables included:

- Sales & Onboarding Ontology

- Use case specific orchestration flow

- Integration with many info sources

Tags / Keywords

#ideatotrade #nextbestproduct #salesadvice #crossindustry

10 - Intraday Liquidity Management Optimization

Intraday Liquidity Management Optimization

Executive summary

In order to avoid long internal lead times and to cater to stringent time-to-market expectations, an end-to-end Analytics Design and streaming real time analytics environment for group wide BCBS (Basel III) Intraday Liquidity Management was implemented. The bank’s predictive liquidity and cash management models were rebuilt from scratch using real-time streams from 13 different SWIFT messaging gateways.

Problem statement

All financial institutions need to be on top of their liquidity levels throughout the entire day. Since every organization usually experiencing many cash inflows and outflows during the day, it is diffcult to understand what are the currenct liquidity levels. To be compliant with the regulations, the liquidity levels need to be monitored. Having too much cash is not commerically viable and too little cash is too risky. Knowing the current cash levels the bank can adjust accordingly. The entire cash balancing act is based on the cascade of different events. Cash flow events and also cash-related events need to be integrated from various transaction management systems.

Target market / Industries

The use case is applicable in all regualted and cash-intence industries, i.e.

- Financial service

- Treasury departments of large corporations

Solution

During the use case implementation 16 different cash-flow generating order systems were integrated using different schemas of how they handle transactions. StreamZero Data Platform was able to resolve the complexities of the event handling to absorb all different situations and rules that need to be applied depending on the different states that the system can take. Data sourcing patterns evolved quickly from single file batch to data streaming using Kafka and Flink. A global end-user enablement was achieved with a multi network environment for regional user and both logical and physical data segregation. Irreversible client data protection using SHA 256 hash algorithm allowed for globally integrated algorithms in spite of highly confidential raw input data. We were able to implement dynamic throttling and acceleration of cash flows depending on current market situations and liquidity levels.

The solution included:

- Adaptor agents to 16 cash-flow generating systems

- Throttling and acceleration logic

- Machine Learning (ML) models for liquidity projection

- Harmonized event architecture

Stakeholders

- Group treasury

- Group risk and compliance

- CFO

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Cash-flows

Assets & Artefacts:

- Harmonized transactional event model

- Throttling and acceleration rule book

The deliverables included:

- End to end solution for intraday liquidity

Impact and benefits

The use-case implementation resulted in:

- 10 MCHF annual savings on liquidity buffers

- 23% reduction of operations & treasury staff

Testimonials

“Moving from a batch to a real-time liquidity monitoring was a substantial task that had countless positive knock-on effects throughout the organization.”

— Mr. Juerg Schnyder, Liquidity expert, Global universal bank

Tags / Keywords

#liquidity #liquiditymanagement #intradayliquiditymanagement #cashmanagement #BCBS #Basel3 #financialservices

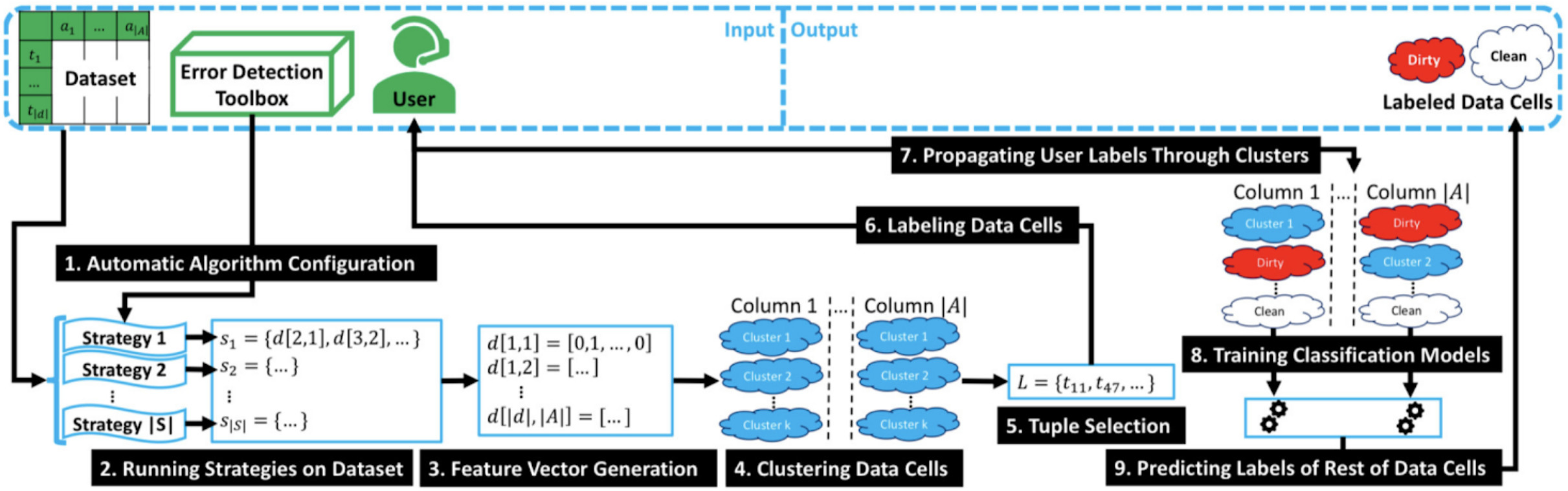

11 - Metadata-controlled Data Quality & Data Lineage in Production

Metadata-controlled Data Quality & Data Lineage in Production

Executive summary

Metadata-controlled data quality & data lineage along the production chain integrated with a laboratory information system for monitoring and quality documentation of various BoM & formulation variations in the biochemical production of active pharmaceutical ingredients (preliminary production of active ingredients in transplant medicine).

Problem statement

Neither technical, nor rule based approaches can adequately help in raising data quality without domain expertise. Using the domain expertise to create the rules is time consuming and often not feasible from the manpower prospective.

Target market / Industries

The use case is applicable to any industry dealing with large volumes of data if insufficient quality, e.g.:

- Serial manufacturing

- Mass production

- Retail

- Financial services

- Cross-industry applications

Solution

The approach is based on few shot manual learning, when the expert creates a few dozens of examples with real-life data. Later on from these examples the model learns strategies to identify and correct data quality errors.

Example Use Case Agent Cascade

Stakeholders

- Domain experts

- Product data quality

- Functional experts

- Risk managers

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Detailed data sets where the quality to be improved

- 20-30 examples of errors and their manual corrections

- Judgement on automated model performance

Assets & Artefacts:

- StreamZero error correction toolbox

The deliverables included:

- Customized data quality improvement workflow

Impact and benefits

The use case implementation allows to address data quality issues in an efficient manner with high quality of the process automation. If the data quality management process would remain manual, this would result in 5-6 Full Time Employees dedicated for this task. The Machine Learning model will over time accumulate respective knowledge and support domain expertise with relevant automated data quality improvement proposals.

Tags / Keywords

#dataquality #dataqualityimprovement #machinelearning #production #manufacturing #serialmanufacturing #massproduction #medicine #laboratory #pharma #financialservices #crossindustry

12 - Onboarding and Fraud Remodelling - Financial Services

Onboarding and Fraud Remodelling

Executive summary

Leverage an industry proven onboarding and Know Your Customer (KYC) ontology and fine-tune it to your corporate compliance policies. Ensure manual processing, existing triggers and information sources are tied together by a unified and harmonized process supporting front-office and compliance simultaneously.

Problem statement

Many financial service providers struggle with the complexity and inefficiency of their client onboarding and recurring KYC monitoring practice. And many have issues, when it comes to Anti-Money Laundering (AML), source of funds and transaction monitoring compliance. The front-office staff often tries to cut corners and the compliance staff is overwhelmed with the number of cases and follow-ups that are required from them. Disintegrated and high-maintenance systems and processes are the usual status quo, with little budget and energy to change from due to the inherent risk.

Target market / Industries

The use case is primarily applicable to the industries that are exposed to frauds and where fraud tracking and prevention is needed. The financial services industry benefiting most from this use-case.

Solution

We combine the domain knowledge of what is really required by law and regulation with the opportunity to automate many aspects of the background screening and adverse media monitoring. By integrating the robustness of process of global players and the lean and mean approach FinTech startups take, we usually are able to raise quality while reducing effort. Creating a centralized compliance officer workbench that is integrated with both front-office systems as well as risk-management and compliance tools, we are able to iteratively improve the situation by synchronizing the learning of the models and predictions with the feedback from compliance experts.

The solution included: -Integrated Compliance Officer Workbench

- Onboarding & Compliance Ontology configuration & subsequent ontology matching

- Integration of existing screening & trigger sources with learning / improvement loops

- Automation of standard cases and pre-filling of high-probability issues

- Aggregation of findings, reporting, alerting & compliance action notifications

Stakeholders

- Compliance

- Security

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Existing client onboarding / KYC policies

- KYC/AML/onboarding management cases

- Client‘s contracts, positions & transactions

Assets & Artefacts:

- Client risk attributes

- Historic client behavior information

The deliverables included:

- Compliance & KYC Ontology

- Compliance Officer Workbench

- Use case specific orchestration flow

Impact and benefits

Decreased compliance team by 30% from 18 down to 12 Fuull-Time Employees by automating standard case load. Increased compliance quality and decreased client case resolution time by eliminating aspects not required by current jurisdictional scope.

Testimonials

“This is a compliance expert‘s dream come true. Before I never had an oversight of where I or my team where standing. Now we can actually support our client facing colleagues.” — Mr. XXX YYY, Title, Company ZZZ.

Tags / Keywords

#fraud #fraudremodelling #compliance #kyc #financialservices #bank

13 - Onboarding and Fraud Remodelling - General

Onboarding and Fraud Remodelling

Executive summary

Leverage an industry proven onboarding and Know Your Customer (KYC) ontology and fine-tune it to your corporate compliance policies. Ensure manual processing, existing triggers and information sources are tied together by a unified and harmonized process supporting sales and compliance simultaneously.

Problem statement

Many service providers struggle with the complexity and inefficiency of their client onboarding and recurring KYC monitoring practice. And many have issues, when it comes to various types of monitoring of client’s activities. The front-office staff often tries to cut corners and the compliance staff is overwhelmed with the number of cases and follow-ups that are required from them. Disintegrated and high-maintenance systems and processes are the usual status quo, with little budget and energy to change from due to the inherent risk.

Target market / Industries

The use case is primarily applicable to the industries that are exposed to frauds and where fraud tracking and prevention is needed.

Solution

We combine the domain knowledge of what is really required by law and regulation with the opportunity to automate many aspects of the background screening and adverse media monitoring. By integrating the robustness of process of global players and the lean and mean approach, we usually are able to raise quality while reducing effort. Creating a centralized compliance officer workbench that is integrated with both front-office systems as well as risk-management and compliance tools, we are able to iteratively improve the situation by synchronizing the learning of the models and predictions with the feedback from compliance experts.

The solution included: -Integrated Compliance Officer Workbench

- Onboarding & Compliance Ontology configuration & subsequent ontology matching

- Integration of existing screening & trigger sources with learning / improvement loops

- Automation of standard cases and pre-filling of high-probability issues

- Aggregation of findings, reporting, alerting & compliance action notifications

Stakeholders

- Compliance

- Security

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Existing client onboarding / KYC policies

- KYC / onboarding management cases

- Client‘s contracts, positions & transactions

Assets & Artefacts:

- Client risk attributes

- Historic client behavior information

The deliverables included:

- Compliance & KYC Ontology

- Compliance Officer Workbench

- Use case specific orchestration flow

Tags / Keywords

#fraud #fraudremodelling #frauddetection #fraudtracking #compliance #kyc

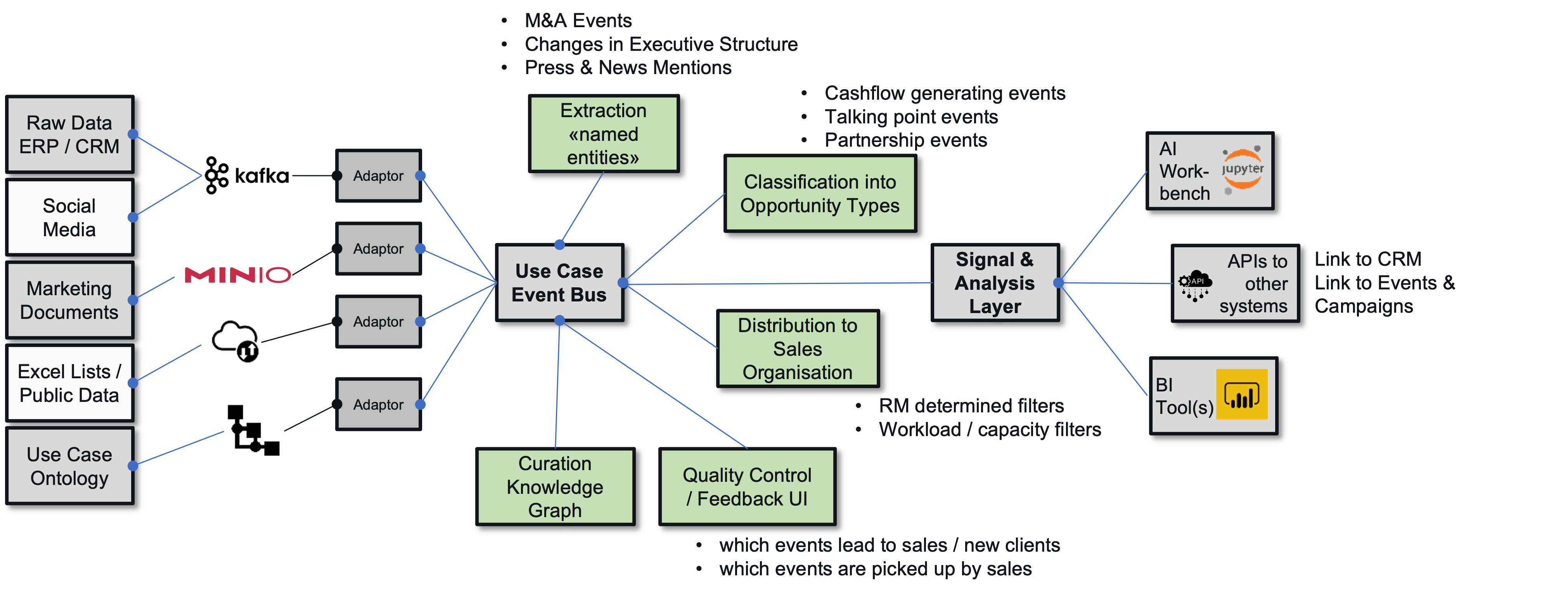

14 - Prospecting 360 Degree

Prospect 360°

Executive summary

For many strategic prospects the preparation of possible offers and establishment of a real relationship either involves great effort or lacks structure and focus. The Prospect 360° use case augments traditional advisor intelligence with automation to improve this original dilemma.

Problem statement

Hunting for new important clients usually is driven by referrals and the search for an “ideal event“ to introduce a product or service. Existing client relationships are usually screened manually and approached directly to request an introduction, prior to offering any services. Monitoring the market and a prospect’s connections can be cumbersome and is error prone – either introductions are awkward or they do not focus on a specific and urgent need. Hence the success and conversion rates seem hard to plan.

Target market / Industries

This use case is traditionally applicable to such industries where the customer engagement and acquisition process is long and costs per customer are high:

- Financial Services

- Insurance

- General Business Services

Solution

We introduce the idea of “soft onboarding”. Instead of selling hard to a new prospect, we start to engage them with tailored and relevant pieces of information or advice free of charge. We do, however, tempt this prospect to embrace little initial pieces of an onboarding-like process, extending the period we are allowed to profile the needs and preferences of the client and the related social graph. Turning a prospect into an interested party and then increasing the levels of engagement of the period of up to six months allows for a more natural and client-driven advisory experience, that is shifting from a “product push” towards a “client pull”.

The solution included:

- Integration of disparate news & event information sources (licensed & public origins)

- Provisioning of select RM & client data points to understand social graphs

- Word parsing of text-based inputs (e.g. news articles and liquidity event streams)

- Onboarding & Sales Ontology matching

- Identification of possible liquidity events, new referral paths & sales topics of interest

- Aggregation of findings, reporting, notifications and organizational routing

- Ideally inclusion of reinforcement learning (via RM, client & assistant feedback loops)

Example Use Case Agent Cascade

Stakeholders

- Relationship Management

- Sales

- Marketing

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

-

Sales organization setup (desks / books)

-

Client to Client / Client to Company graphs

Capabilities utilized:

- Unstructured Data

- Semantic Harmonization

- NLP

- Personalization

Assets & Artefacts:

- Financial Product Ontology

- Analytical CRM Models

The deliverables included:

- Sales & Onboarding Ontology

- Use case specific orchestration flow

- Integration with many info sources

Impact and benefits

Strategic client team originally covered 200 prospects manually. Introducing Prospect 360° allowed to double that number while reducing the time-to-close by 35% — from more than 12 to an average of about 7 months.

The use-case implementation resulted in:

+8% growth of corporate loan book

+22% reduction on credit defaults

Testimonials

“I feel a lot more as a real advisor. I can be helpful and feel informed. And I still can make my own judgments of what is relevant for my personal relationship to existing clients and new referrals. I learn as the system learns.”

— Mr. Pius Brändli, Managing Director, Credit Suisse

Tags / Keywords

#kyc, #knowyourcustomer, #finance, #financialservices, #onboarding, #prospecting, #prospect360

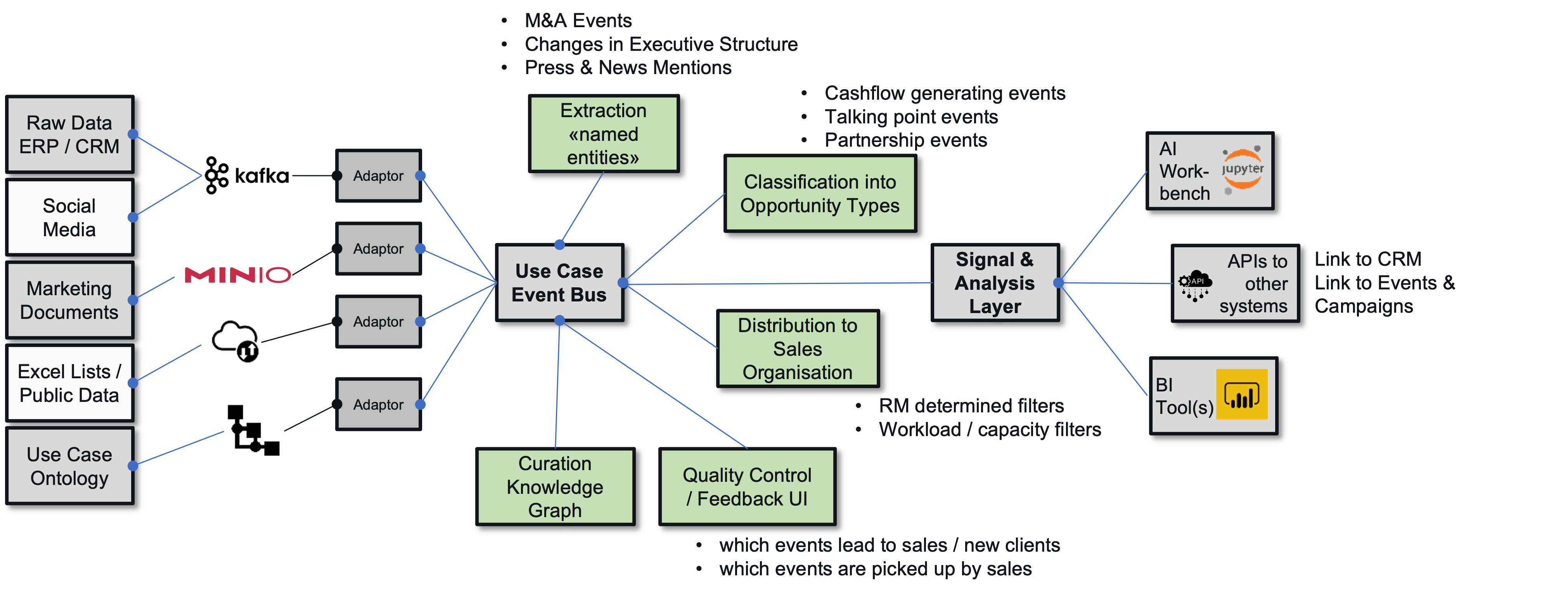

15 - Prospecting 360 Degree - general

Prospect 360°

Executive summary

For many strategic prospects the preparation of possible offers and establishment of a real relationship either involves great effort or lacks structure and focus. The Prospect 360° use case augments traditional sales and marketing intelligence with automation to improve this original dilemma.

Problem statement

Hunting for new important clients usually is driven by advertisement, referrals and the search for an “ideal event“ to introduce a product or service. Existing client relationships are usually screened manually and approached directly to request an introduction, prior to offering any services. Monitoring the market and a prospect’s connections can be cumbersome and is error prone – either introductions are awkward or they do not focus on a specific and urgent need. Hence the success and conversion rates seem hard to plan.

Target market / Industries

This use case is suitable for the industries where the customer engagement and acquisition process is long and costs per customer are high.

Solution

We introduce the idea of “soft onboarding”. Instead of selling hard to a new prospect, we start to engage them with tailored and relevant pieces of information or advice free of charge. We do, however, tempt this prospect to embrace little initial pieces of an onboarding-like process, extending the period we are allowed to profile the needs and preferences of the client and the related social graph. Turning a prospect into an interested party and then increasing the levels of engagement of the period of up to six months allows for a more natural and client-driven sales experience, that is shifting from a “product push” towards a “client pull”.

The solution included:

- Integration of disparate news & event information sources (licensed & public origins)

- Provisioning of select sales & client data points to understand social graphs

- Word parsing of text-based inputs (e.g. news articles)

- Onboarding & Sales Ontology matching

- Identification of new referral paths & sales topics of interest

- Aggregation of findings, reporting, notifications and organizational routing

- Ideally inclusion of reinforcement learning (via sales, client & assistant feedback loops)

Example Use Case Agent Cascade

Stakeholders

- Relationship Management

- Sales

- Marketing

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Sales organization setup (desks / books)

- Client to Client / Client to Company graphs

Capabilities utilized:

- Unstructured Data

- Semantic Harmonization

- NLP

- Personalization

Assets & Artefacts:

- Product Ontology

- Analytical CRM Models

The deliverables included:

- Sales & Onboarding Ontology

- Use case specific orchestration flow

- Integration with many info sources

Tags / Keywords

#newclients #salesfunnel #sales #marketing #salesautomation #prospecting #prospect360

16 - Regulatory Single Source of Truth

Regulatory Single Source of Truth

Executive summary

Leveraging all existing data sources from core banking, risk- and trading systems to the Customer Relationship Management (CRM) and general ledger as granular input for your regulatory Single Source of Truth (SSoT).

Problem statement

Most regulatory solutions today require huge maintenance effort on both business and technology teams. Ever more granular and ever more near-time regulatory requirements further increase this pressure. Usually the various regulatory domains have created and continue to create silos for central bank, credit risk, liquidity, Anti-Money Laundering (ALM) / Know Your Customer (KYC) and transaction monitoring regulations. Further requirements from ePrivacy, Product Suitability and Sustainability regulations even further dilute these efforts.

Target market / Industries

- Financial services

- Insurance

Solution

Leveraging the semantic integration capabilities of StreamZero Data Platform, it allows you to reuse all the integration efforts you have previously started and yet converge on a common path towards an integrated (regulatory) enterprise view. The ability to eliminate high-maintenance Extraction Transformation Loading (ETL) coding or ETL tooling in favor of a transparent and business driven process will save you money during the initial implementation and during ongoing maintenance. Templates and a proven process were applied to use what exists and build what’s missing without long-term lock in.

The solution included:

- Semantic Integration leveraging all your prior integration investments

- Business driven data standardization and data quality improvements

- No Code implementation => business analysis is sufficient to generate the integration layer

- Implement data governance & data quality via reusable business checks

- Multiply your regulatory investments to be used for analytics, sales and risk

Stakeholders

- Compliance

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Full regulatory granular scope master & reference data (incl. UBO hierarchies)

- Client portfolio (positions / transactions)

Assets & Artefacts:

- Private Bank Data Model

- Optimization Algorithms

- Data Quality Business Rules

The deliverables included:

- E2E Models & Integration Schema

- Library of Business Checks

Impact and benefits

The semantic SSoT is now used by other functions across the bank leveraging regulatory investments for sales support, operations and risk management.

The use-case implementation resulted in:

9% reduction of risk weighted assets

9 FTE (50%) reduction of regulatory reporting team

In addition, recurring Cost of Capital savings of over 15m CHF p.a. were achieved.

Testimonials

“We have semantically integrated +220 different data sources at Switzerland largest independent Private Bank. The regulatory team was able to deliver better results faster and yet decreased the team size by 30%.” — Mr. XXX YYY, Title, Company ZZZ.

Tags / Keywords

#singlesourceoftruth #ssot #bank #privatebank #financialservices #insurance

17 - Sensor-based Monitoring of Sensitive Goods

Sensor-based Monitoring of Sensitive Goods

Executive summary

Sensor-based monitoring of sensitive goods along the transport chain (location, light, temperature, humidity & shocks in one sensor) and integration of these IoT components in a smart and decentralized cloud including the event-controlled connection to the relevant peripheral systems.

Problem statement

One of the biggest problems that exist in supply chain management is the lack of visibility and control once materials have left the site or warehouse. This leads to billions in losses due to missing or damaged products and leads to business inefficiency.

Target market / Industries

The use case can be applied for the following solutions:

- Intelligent packaging

- Intelligent logistics

- Industrial applications – Industry 4.0

- Consumer and luxury goods

- Home protection

Solution

A small-size energy-autonomous intelligent cells (microelectronic parts) are integrated into any object / package to enable remain in contact to it, identify it electronically, provide a location and sense temperature, pressure, movement, light, and more. They are intelligent, able to make basic decisions and save small information pieces. The cells communicate bidirectionally with the software through global IoT networks of our partners selecting the best energy-efficient technologies available where they are and building a neuronal backbone of objects in constant communication. Bidirectional capabilities allow transmitting data of the sensors and receiving instructions and updates remotely. Cells can also interact with the electronics of the objects they are attached to, they can read and transmit any parameters and providing remote control of them wherever they are. All data of the cells are transmitted to our own cloud applications, a learning brain using the power of data management and AI of Google Cloud and Microsoft Azure where we can combine IoT data of objects with any other data in intelligent and self-learning algorithms. The location or any other parameter of the objects can be displayed in any Browser or Smart device. The user interfaces can be customized and allow to interact at any moment changing frequency of connection, SMS or email alarm values and who receives them (human or machine) or acting as remote control of any object. All of this can be offered fully pay peruse, to ensure a very low entry point for the technology. You can turn the cell on and off remotely, and only pay cents per day when you use the cell capabilities or buy the solution.

Stakeholders

- Manufacturers

- Logistic services providers

- General management

- Supply chain

- Digitalization

- Quality control

- Risk management

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Container / goods data

- Transport routing

- Thresholds / boundary conditions

- Past Quality Control data for pattern recognition

Assets & Artefacts:

- Routing optimization model

- IoT cloud backbone

The deliverables included:

- Driver dispatcher and client apps

- Operational routing optimization

Tags / Keywords

#sensorbasedmonitoring #iot #sensitivegoods #intelligentpackaging #intelligentlogistics #industry40 #industry #packaging #logistics #homeprotection #consumergoods #luxurygoods

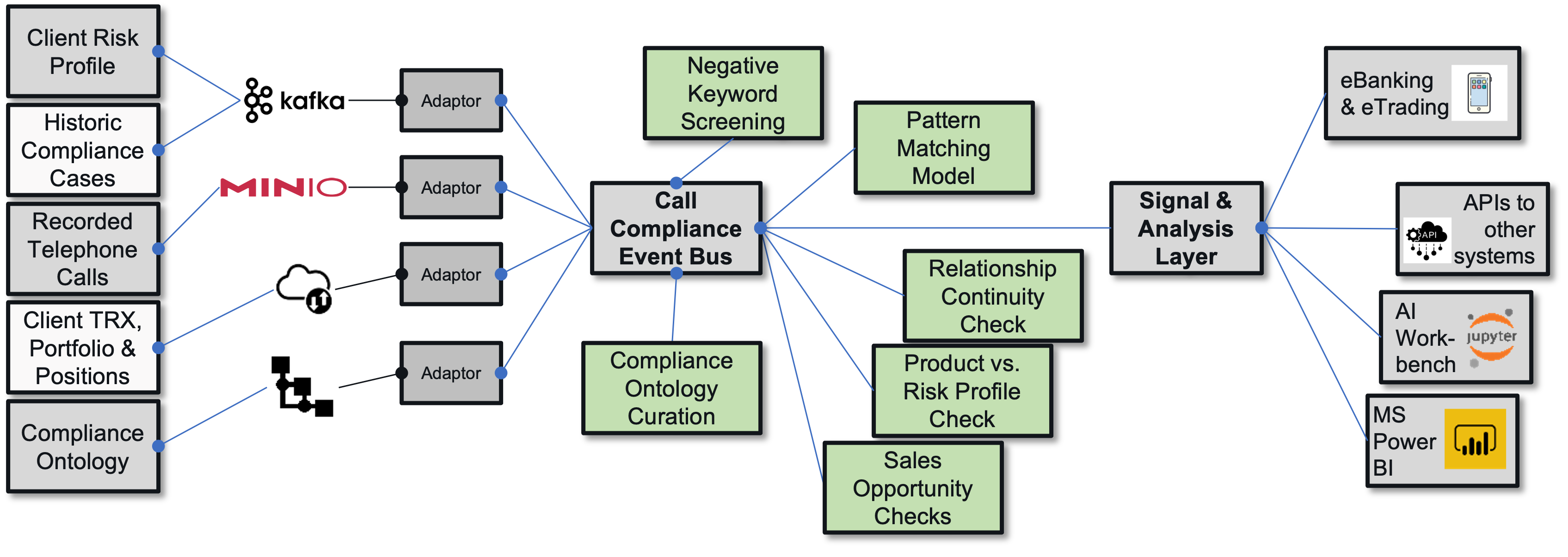

18 - Voice-based Trade Compliance

Voice-based Trade Compliance

Executive summary

Convert the voice-based advisor to client phone conversations into text. Analyze for possible breaches of regulatory and compliance policies. This multi-step analytical process involves voice-to-text transcription, a compliance ontology, text parsing & natural language understanding.

Problem statement

Many if not most client advisors to client communications still occur via phone. These conversations happen in a black box environment that is difficult to track and audit. Potential compliance breaches in areas such as insider trading or conflict of interest can only be identified and intercepted at great cost while only listening in on select phone calls. The vast majority of conversation remains unchecked, leaving the organization in the dark and at risk. Often compliance is at odds with sales – one controlling the business, the other pushing the boundaries of acceptable risk.

Target market / Industries

Described use case can be efficiently applied in the industries where the track / audit of the voice-based communication is required.

Solution

Leveraging your existing Public Branch eXchange (PBX) phone recording infrastructure & partnering with your choice of voice-to-text transcription service, the solution is to automatically screen every conversion. The transcribed text files are parsed against the Sales & Compliance Ontology. Using Natural Language Understanding (NLU) the use case identifies which call advice and trade decisions occurred and high-lights possible compliance breaches.

Once the predictions become more accurate a sales focused “topics-of-interest“ screening can be added.

The solution included:

- Voice to text transcription

- Word parsing of text-based inputs

- Compliance & Sales Ontology matching

- Identification of possible compliance breaches (and / or sales topics of interest)

- Aggregation of findings, reporting, alerting

- Action recommendation

Example Use Case Agent Cascade

Stakeholders

- Compliance

- Security

Data elements, Assets and Deliverables

As an Input from the client, the following items were used:

- Relationship Manager – Client Conversations (Voice or Text)

- Client portfolios - positions / transactions

Assets & Artefacts:

- Unstructured Data

- Semantic Harmonization

- Natural language processing

- Personalization

The deliverables included:

- Sales & Transaction Monitoring Ontology

- Use case specific orchestration flow

Impact and benefits

Sales Compliance headcount was reduced by 3 Full Time Employees while screening coverage increased to 90% (before only spot checks) and resolution quality focuses on sales and compliance.

Testimonials

“The overall sensitivity of advisors to client‘s sentiment and requirements has increased. Also, we improved the understanding how compliance and sales can work together to achieve client satisfaction.” — Ms. Milica L., Chief Risk Officer, Swiss Private Bank

Tags / Keywords

#voicetradecompliance #tradecompliance #compliance #bank #communicationscreening #financialservices